west st paul mn sales tax rate

Lower sales tax than 71 of Minnesota localities 125 lower than the maximum sales tax in MN The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales tax and 025 Special tax. Did South Dakota v.

Sales Taxes In The United States Wikiwand

This 05 percent sales tax applies to retail sales made into West St.

. What is the sales tax rate in Saint Paul Minnesota. 05 percent West St. Saint Paul is in the following zip codes.

Sales Tax Breakdown West Saint Paul Details West Saint Paul MN is in Dakota County. Find your Minnesota combined state and local tax rate. The sales tax rate does not vary based on.

As of October 1 2019 the lodging tax on hotels and motels with more than 50 rooms was increased from 3 to 4. Sales Tax Breakdown Saint Paul Details Saint Paul MN is in Ramsey County. Saint Paul Sales Tax Rates for 2022.

Saint Paul MN Sales Tax Rate The current total local sales tax rate in Saint Paul MN is 7875. Within South Saint Paul there is 1 zip code with the most populous zip code being 55075. For tax rates in other cities see Minnesota sales taxes by city and county.

Apply the combined 7375 percent rate plus any other local taxes that apply to the sales price. Saint Paul in Minnesota has a tax rate of 788 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Paul totaling 1. The December 2020 total local sales tax rate was also 7875.

This is the total of state county and city sales tax rates. The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply. The Saint Paul Sales Tax is collected by the merchant on all qualifying sales made within Saint Paul.

South Saint Paul is located within Dakota County Minnesota. Each taxpayers West St. The 2022 proposed budget includes a 69 increase in the property tax levy.

If you believe theres been an overstatement of your levy dont delay. Changes in your propertys market value and changes in the Citys tax levy among other factors will impact what you pay in taxes next year. 55101 55102 55103.

Paul will implement a 5 Sales and Use Tax to fund the rebuilding and repair of essential transportation corridors and related ancillary roads within the City. The West Saint Paul sales tax rate is 05. There is no applicable county tax or.

Did South Dakota v. Paul Minnesota is 7375. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax.

Sales tax rate in West St. Within Saint Paul there are around 33 zip codes with the most populous zip code being 55106. Local tax rates in Minnesota range from 0 to 15 making the sales tax range in Minnesota 6875 to 8375.

This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County. Wayfair Inc affect Minnesota. There is no applicable county tax.

Compare the estimated value with other community houses in particular newly sold. Paul MN 55146-6330 Or visit our website at wwwrevenuestatemnus. The Minnesota sales tax rate is currently 688.

The average cumulative sales tax rate in South Saint Paul Minnesota is 713. The Citys lodging tax is administered by the Minnesota Department of Revenue. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure.

The minimum combined 2022 sales tax rate for West Saint Paul Minnesota is 763. This includes the rates on the state county city and special levels. The current total local sales tax rate in West Saint Paul MN is 7625.

This is the total of state county and city sales tax rates. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The City of Saint Paul has created a property tax estimator to allow residents to understand estimated changes in their property taxes from year to year.

This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County. The lodging tax on hotels and motels with 50 or fewer rooms is 3. The County sales tax rate is 0.

Minnesota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a. The County sales tax rate is 0. The Saint Paul Minnesota sales tax is 688 the same as the Minnesota state sales tax.

You can find more tax rates and allowances for West Saint Paul and Minnesota in the 2021 Minnesota Tax Tables. Historical Sales Tax Rates for Saint Paul 2022 2021 2020 2019. Paul use tax is line number 634.

For Sale - 1938 Christensen Ave West Saint Paul MN - 315000. The average cumulative sales tax rate in Saint Paul Minnesota is 758. The December 2020 total local sales tax rate was also 7625.

While many other states allow counties and other localities to collect a local option sales tax Minnesota does not permit local sales taxes to be collected. The base state sales tax rate in Minnesota is 688. The Saint Paul sales tax rate is 05.

This includes the rates on the state county city and special levels. Paul assessment is available to the public on the web. Paul Local Sales Tax will be collected through December 31 2040.

The West Saint Paul Minnesota sales tax is 713 consisting of 688 Minnesota state sales tax and 025 West Saint Paul local sales taxesThe local sales tax consists of a 025 special district sales tax used to fund transportation districts local attractions etc. Paul 05 Sales and Use Tax On January 1st 2020 the City of West St. The Minnesota sales tax rate is currently 688.

Automating sales tax compliance can help your business keep compliant with changing. You can find more tax rates and allowances for Saint Paul and Minnesota in the 2022 Minnesota Tax Tables. Sales and Use Tax Division Mail Station 6330 St.

The minimum combined 2022 sales tax rate for Saint Paul Minnesota is 788. An additional 3 tax applies to all lodging facilities with more than 50 rooms. Not a worry should you feel confused.

Research recent hikes or drops in property selling price trends. The current total local sales tax rate in Saint Paul. West Saint Paul in Minnesota has a tax rate of 713 for 2021 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in West Saint Paul totaling 025.

Saint Paul has parts of it located within Dakota County Hennepin County Ramsey County and Washington County. You can print a 7875 sales tax table here. Paul sales tax is line number 633.

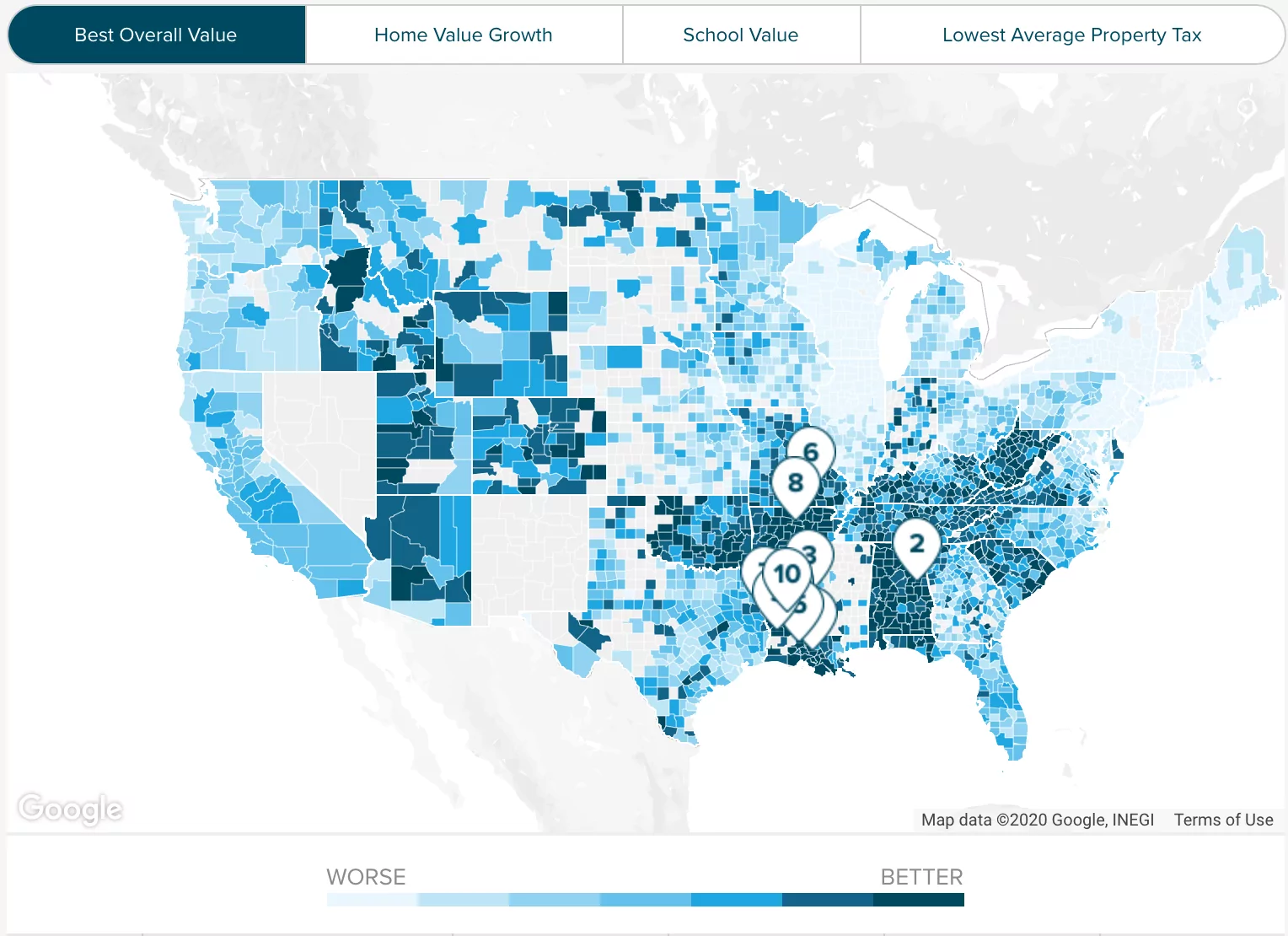

Property Taxes Historical Data Mn House Research

Property Taxes Historical Data Mn House Research

Sales Taxes In The United States Wikiwand

Local Option Taxes For Transportation

Local Sales Tax Option Saint Peter Mn

Sales Taxes In The United States Wikiwand

Taxation Of Social Security Benefits Mn House Research

Impact Of Introducing A Minimum Alcohol Tax Share In Retail Prices On Alcohol Attributable Mortality In The Who European Region A Modelling Study The Lancet Regional Health Europe

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Minnesota Sales And Use Tax Audit Guide

Property Taxes Historical Data Mn House Research

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Dakota County Mn Property Tax Calculator Smartasset

Sales Tax Rate Calculator Minnesota Department Of Revenue

Local Sales Tax Option Saint Peter Mn

Minnesota Sales Tax Rates By City County 2022

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders